by Tim Storm | Aug 27, 2017 | Blog, VA Loan Information

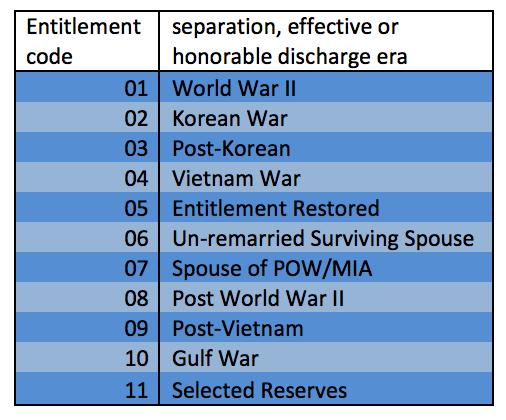

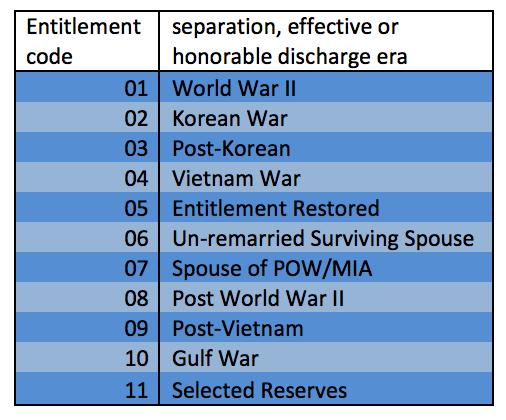

The first step a California Veteran will need to complete in securing a VA loan is to obtain your Certificate of Eligibility. The Certificate of Eligibility, also known as the the COE, is a document that the Veterans Adminstration issues, which verifies your eligibility for VA financing. On the COE there is a number listed that is known as the Entitlement Code. The Entitlement Code shows during what period you earned your eligibility, or other alternative ways in which you became eligible for the VA mortgage program. The chart below shows the entitlement codes and what methods of eligibility they represent.

Subsequent Use of VA Eligibility

A common Entitlement Code is “05”. This means that the Veteran has used VA financing previously and signifies to the lender that a subsequent use VA Funding Fee will be required, unless the COE also verifies the Funding Fee is waived (in the case of a service connected disability).

These periods and methods of eligibility have certain minimum service periods that are required to establish your eligibility for the VA loan program. Each time period has different service requirements. This next chart lists out the dates that define each time period of service as well as their minimum service requirement for those periods.

Easiest Method for Obtaining your Certificate of Eligibility

While it is possible for a Veteran to retrieve their Certificate of Eligibility directly from the VA, the easiest way to retrieve the COE is through a VA approved mortgage lender. VA approved lenders have direct access to pull COE’s and in many cases can retrieve your COE within seconds of inputting the information into the VA portal. It seems that 50% of the time the DD214 will need to be uploaded, and depending various circumstances, it can take a few days to retrieve the COE. It so easy for a lender to retrieve your COE that contacting a local VA lender should be your first step in the loan process.

Authored by Tim Storm, a California Loan Officer specializing in VA Loans. MLO 223456. – Please contact my office at the Home Point Financial. My direct line is 949-640-3102. www.CaliforniaVALoanExpert.com. I will prepare custom VA loan scenarios which will be matched up to your financial goals, both long and short term. I also prepare a Video Explanation of the your scenarios so that you are able to fully understand the numbers BEFORE you have started the loan process.

by Tim Storm | Feb 22, 2017 | Blog, VA Loan Information

The Certificate of Eligibility (COE) is an important step in starting the VA loan process. This document declares your eligibility for the VA loan program. When looking to start the loan process, you can either get the COE yourself or have your California VA lender request it for you. The fastest and easiest way to retrieve your COE is to have your lender do it.

Regardless of which way you decide to obtain your Certificate of Eligibility, you will need to provide proof of service for your lender. If you served in the armed forces you will need to provide your DD214, which is also known as the Certificate of Release or Discharge papers, for your proof of service. Copy 4 of the DD-214 is the preferred version for the VA program because it provides the most details regarding your service. For members of the national guard and reserves, you will have to show your most recent annual retirement summary as their proof of service. You can still submit a request for a COE even if you don’t have a proof of service form because in some cases the VA can determine your eligibility based on their own records.

If you decide to go about obtaining your COE yourself there are a couple different ways that you can go about getting it. You can use the VA online ebenefits portal, visit your nearby regional loan center or mail in the needed documents. If you decide to have your lender get the COE it is a much simpler and quicker process. If you have your lender request the COE, all you need to do is provide them with your proof of service. In some cases, your lender may be able to retrieve your COE in minutes without the proof of service. Lenders are able to use the VA Automated Certificate of Eligibility portal to request your COE and determine your eligibility in a matter of minutes. In some cases, the automated portal will be unable to make a decision but it will still be a faster process for your lender to get the COE. Even if you have already received your Certificate of Eligibility, your lender will still go online to pull an updated version, so having the lender pull it in the first place is the best way to go in most cases.

Authored by Tim Storm, an Orange County VA Loan Officer specializing in VA Loan. MLO 223456. – Please contact my office at the Home Point Financial. My direct line is 949-640-3102. I will prepare custom VA loan scenarios which will be matched up to your financial goals, both long and short-term. I also prepare a Video Explanation of the your scenarios so that you are able to fully understand the numbers BEFORE you have started the loan process.

by Tim Storm | Jun 5, 2014 | Blog

California Veterans using the VA home loan program are able to buy homes with no down payment up to the county limit. But what does it take to be eligible for a VA loan, especially when it comes to someone who has served in the National Guards or Reserves. Many of those who have served in the National Guard or Reserves are not even aware that they qualify for the VA home loan program.

California Veterans using the VA home loan program are able to buy homes with no down payment up to the county limit. But what does it take to be eligible for a VA loan, especially when it comes to someone who has served in the National Guards or Reserves. Many of those who have served in the National Guard or Reserves are not even aware that they qualify for the VA home loan program.

Why a California VA Home Loan is so Awesome

Loan programs allowing for $0 down financing are mostly a thing of the past. There are programs like FHA, which only require a down payment of 3.5%. But FHA also has a fairly expensive monthly mortgage insurance payment for the life of the loan that VA does not have. So while an FHA borrower will pay several hundred dollars a month in some cases for the privilege of only needing 3.5% down payment, VA allows for $0 down AND has no monthly mortgage insurance. Other advantages include:

- The California VA approved condo list is much bigger than the FHA approved condo list

- The California VA loan limits in most county’s are higher than the FHA loan limits. For example, in Orange county and Los Angeles county, the FHA loan limit is $625,500. The VA loan limit in both county’s is $687,500.

- The Jumbo VA Loan. Many VA lenders who close VA loans above the 100% financing loan limit. The Veteran needs to come in with a small down payment, but loan amounts can be as higher as $1,500,000.

- VA 30 year fixed rates tend to compare very favorably to Conventional and Jumbo 30 year fixed programs.

How a Reservist or National Guard becomes Eligible for a VA Home Loan

A Reservist or National Guard member may qualify for a VA home loan if they meet one of the following qualifications:

- Served 6 years in the Selected Reserve or National Guard and were either; a) Honorably discharged; or b)Retired; or c)transferred to Standby Reserve, or an element of the Ready Reserve other than the Selected Reserve, after honorable service

- Served in the Selected Reserves for more than 6 years

- Served as active duty for more than 90 days during a wartime period or 181 days during peace time

- Discharged or released from active duty for a service related disability

How to Get your Certificate of Eligibility

An easy way to retrieve your Certificate of Eligibility, which will verify your eligibility for a VA home loan, is to contact a California VA lender. A VA lender can quickly access the VA portal and request the Certificate of Eligibility. In some cases, either a DD214 (for discharged Veterans) or Statement of Service (for active) will be needed, as well as the completion of VA Form 26-1880, the Request for Certificate of Eligibility. This can also be provided by the California VA Lender.

The first in any home buying process is to contact a lender who can prepare custom VA loan scenarios with details on the purchase price, payment, and closing costs. Consulting with an experienced California VA lender is important if the home buyer wants to have a smooth home buying experience with no last minute “surprises”.

Authored by Tim Storm, a California VA Loan Officer specializing in VA Loans. MLO 223456. – Please contact my office at the Home Point Financial. My direct line is 949-640-3102. I will prepare custom VA loan scenarios which will be matched up to your financial goals, both long and short term. I also prepare a Video Explanation of the your scenarios so that you are able to fully understand the numbers BEFORE you have started the loan process.

by Tim Storm | Dec 4, 2013 | Blog

Many Veterans don’t realize that it is possible to restore VA eligibility for a home loan. The VA home loan is not just for first time home buyers and is not a one time use program. However, there are guidelines that effect a Veterans ability to have more than one VA loan at a time. It is important that once a previous VA home loan has been paid off that the Veteran notify VA of the disposition of the loan. Once VA has proof of the pay off of the loan then the Veterans Entitlement can be restored. There are a few different possibilities when it comes time to restore your VA eligibility.

Many Veterans don’t realize that it is possible to restore VA eligibility for a home loan. The VA home loan is not just for first time home buyers and is not a one time use program. However, there are guidelines that effect a Veterans ability to have more than one VA loan at a time. It is important that once a previous VA home loan has been paid off that the Veteran notify VA of the disposition of the loan. Once VA has proof of the pay off of the loan then the Veterans Entitlement can be restored. There are a few different possibilities when it comes time to restore your VA eligibility.

Use the VA Form 26-1880 to Restore VA Eligibility

- If you bought a home with a VA home loan previously and then sold the home you will need to complete the VA Form 26-1880 (you will complete the form in any situation). You will also need to send in a copy of the certified closing statement for the sale of the home. Once VA verifies the loan has been paid off satisfactorily then the Entitlement and VA eligibility should be restored back to 100%.

- If you bought a home with VA financing previously and later paid off the VA loan but still own the home, then you may apply for a One Time Only Restoration of Entitlement to purchase another home. Proof of the loan being paid off needs to be verified by VA, and of course the complete VA Form 26-1880 needs to be completed.

- If you bought a home previously with VA financing and later sold the home, with the buyer assuming your VA loan, then you may use the 1880 form to check as to whether you have at least a partial Entitlement remaining. Until the assumed VA loan is paid off you will not have 100% Entitlement. However, depending on the new purchase price you may still be able to buy a home with VA financing with $0 down with a partial Entitlement.

Retrieve Your Certificate of Eligibility Before you Make an Offer on a Home

It is very important that you retrieve your Certificate of Eligibility before making an offer on a home. The VA Form 26-1880, also known as the Request for Certificate of Eligibility, just needs to be submitted to VA. For California Veterans, the fastest and easiest way to do this is through a California VA approved lender, who can quickly access the Certificate of Eligibility through the VA portal. A direct California VA lender should be able to access the Certificate of Eligibility within minutes in many cases. If there is information that VA needs to verify it could take a few days, but is still quicker than having the Veteran mail the 1880 form in.

Authored by Tim Storm, a California VA Loan Officer specializing in VA Loans. MLO 223456. – Please contact my office at the Home Point Financial. My direct line is 949-640-3102. I will prepare custom VA loan scenarios which will be matched up to your financial goals, both long and short term. I also prepare a Video Explanation of the your scenarios so that you are able to fully understand the numbers BEFORE you have started the loan process.

by Tim Storm | Feb 26, 2011

California VA Loan Requirements & Eligibility The VA loan program allows for $0 down financing, which is great for California Veterans and active duty military personnel. Who is eligible for this program, and what does it take to verify your eligibility? These...