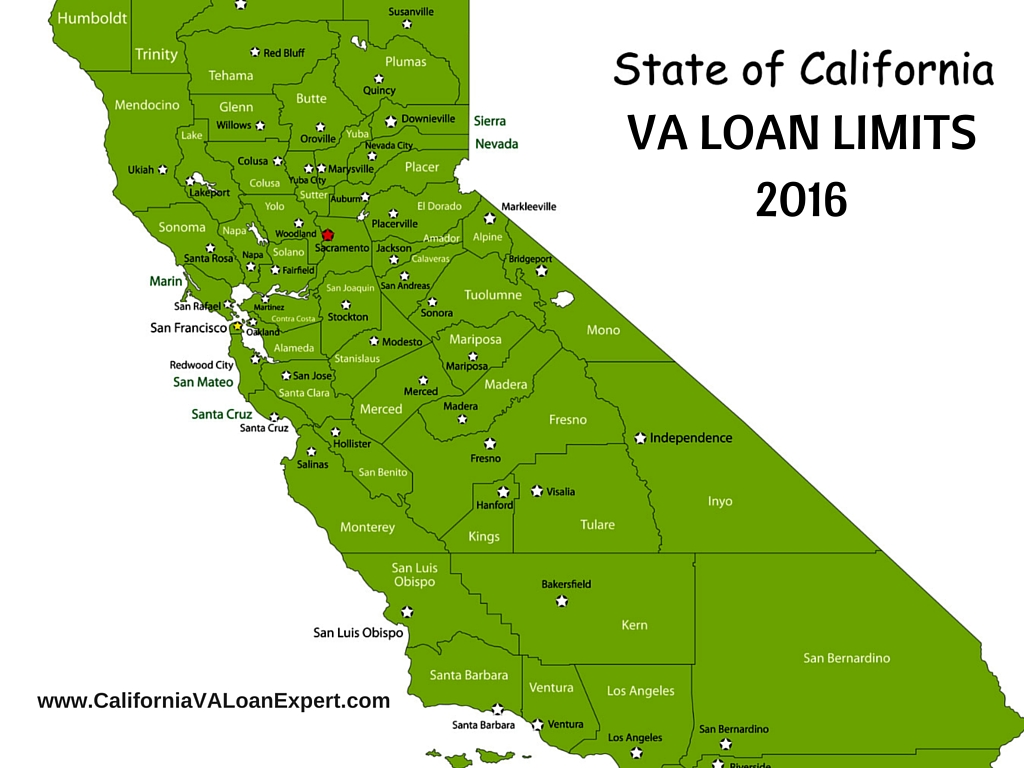

The California VA loan limits for 2016 were recently announced and are mostly unchanged from the limits of 2015. However, there were four California counties that did experience an increase in loan limits.

VA Loan Limits Can Differ for each California County

Loan limits are calculated by the Federal Housing Finance Agency (FHFA). FHFA reviews data annually based on an October to October calendar. The standard VA limit for a county is $417,000. But if FHFA determines a county to be “High Cost” then the loan limit can be higher than $417,000, up to a maximum of $625,500. There are 24 counties in California that are considered to by “high cost” and so have limits above $417,000. Of those, 12 are at the maximum limit of $625,500. Orange County, Los Angeles and San Francisco counties are included in those with the highest limit.

California Counties with Increases in VA Loan Limits

Monterey County, which had a VA loan limit in 2015 of $502,550 got an increase of $26,450 to it’s 2016 limit of $529,000. Napa County’s VA loan limit increased from $612,250 to the max VA loan limit of $625,500. San Diego County, which has a 2015 loan limit of $562,350 is now set at $580,750 for 2016. And Sonoma County had a $33,350 increase, from $520,950 to $554,300 in 2016.

VA Loan Limit Refers to the 100% Financing Limit

It is important to note that when we say “VA Loan Limit” we are talking about the 100% financing limit, or Zero Down loan limit. Because it is possible to get a VA loan that is higher than a counties 100% financing limit. Loans that go above the 100% loan limit are known as Jumbo VA Loans are require a down payment.

For example, in Orange County it is possible for a California Veteran to purchase a home for up to $625,500 with no down payment. If the Veteran finds the home of their dreams, but at a higher price, they will just need a down payment equal to 25% of the difference between the counties $0 down loan limit of $625,500 and the higher purchase price. So if the Veteran finds a home for $725,500, or an even $100,000 above the loan limit (just trying to make the calculation easy), the required down payment is $25,000. The VA loan would be $700,500. This also means that this Veteran was able to buy a $725,500 home in Orange County with only 3.5% down payment. That is awesome.

Authored by Tim Storm, an Orange County VA Loan Officer specializing in VA Loans. MLO 223456. – Please contact my office at the Home Point Financial. My direct line is 949-640-3102. I will prepare custom VA loan scenarios which will be matched up to your financial goals, both long and short-term. I also prepare a Video Explanation of the your scenarios so that you are able to fully understand the numbers BEFORE you have started the loan process.